17 Jul July 2024 Update

What’s ahead for 2024-25?

Will 2024-25 be another year of volatility or a return to stability?

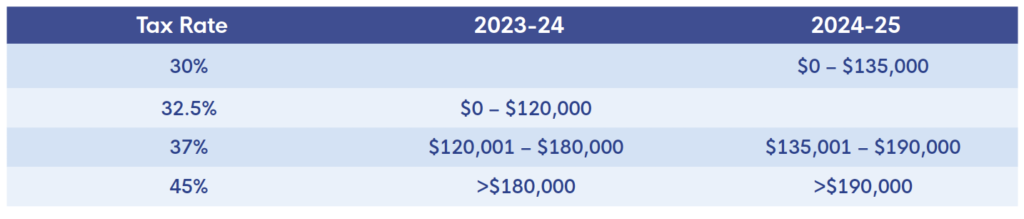

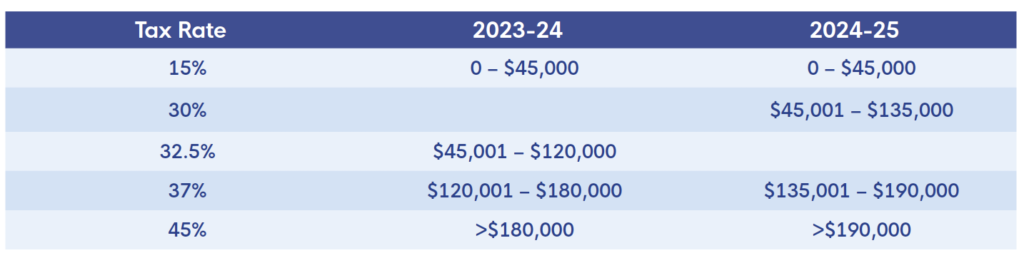

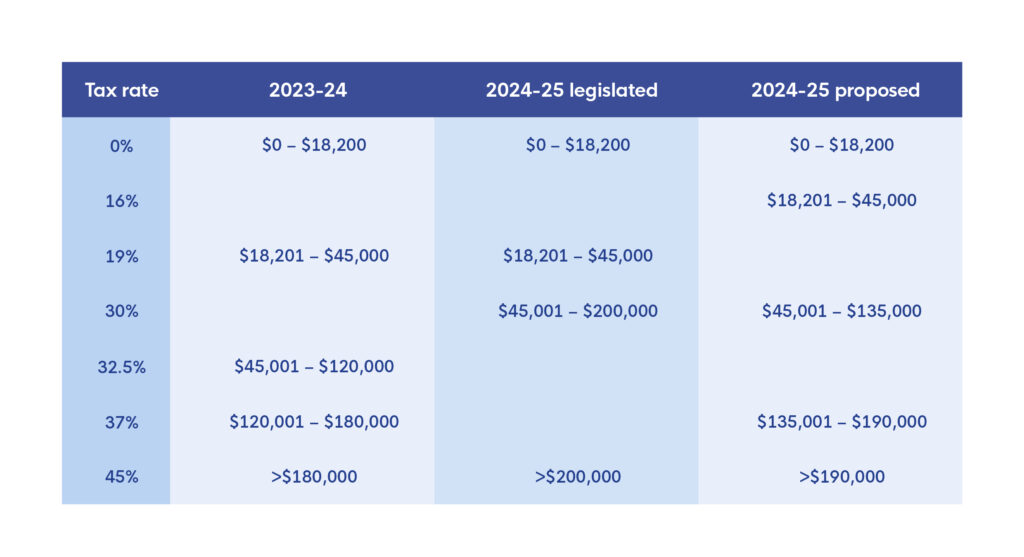

Personal tax & super

As you would be aware (at least we hope so after a $40m public education campaign), the personal income tax cuts came into effect on 1 July 2024. At the same time, the superannuation guarantee (SG) rate increased by 0.5% to 11.5%.

For employers, it’s critically important to ensure that your payroll system, and all interactions with it, like salary sacrifice agreements, are assessed and updated. Your PAYG withholding will also be impacted.

While we are on the topic of obligations, the ATO have recently warned employers to be vigilant about their super guarantee obligations:

- Are you paying super guarantee to the right people? The definition of an employee for SG purposes is broad and, in some cases, extends beyond typical classifications. Temporary residents, backpackers, and some company directors working in the business, family members working in the business, and some contractors must be paid SG. Check your classifications are correct for SG purposes.

- Check the fund details are correct for the employee and the employee’s tax file number has been provided to the super fund. It’s the employer’s obligation to ensure that SG for the employee is directed to the correct super fund account.

- Ensure SG is paid into the employee’s fund by the quarterly due date (next SG payments are due by 28 July). If your business misses the deadline, the super guarantee charge applies (even if you pay the outstanding amount quickly after the deadline). The SG charge (SGC) is particularly painful for employers because it is comprised of the outstanding SG, 10% interest p.a. from the start of the quarter, and an administration fee. And, unlike normal SG contributions, SGC amounts are not deductible.

Wages

On 1 July 2024, the national minimum wage increased by 3.75% ($24.10 per hour, or $915.90 per week). The increase applies from the first full pay period starting on or after 1 July 2024. Traditionally, there is no correlation between an increase in minimum wages and inflation.

Annual wage growth in the private sector fell slightly to 4.1% in the March quarter 2024 from 4.2% in December 2023 – the first fall since September quarter 2020, suggesting that wages growth is starting to even out.

Interest rates and cost of living

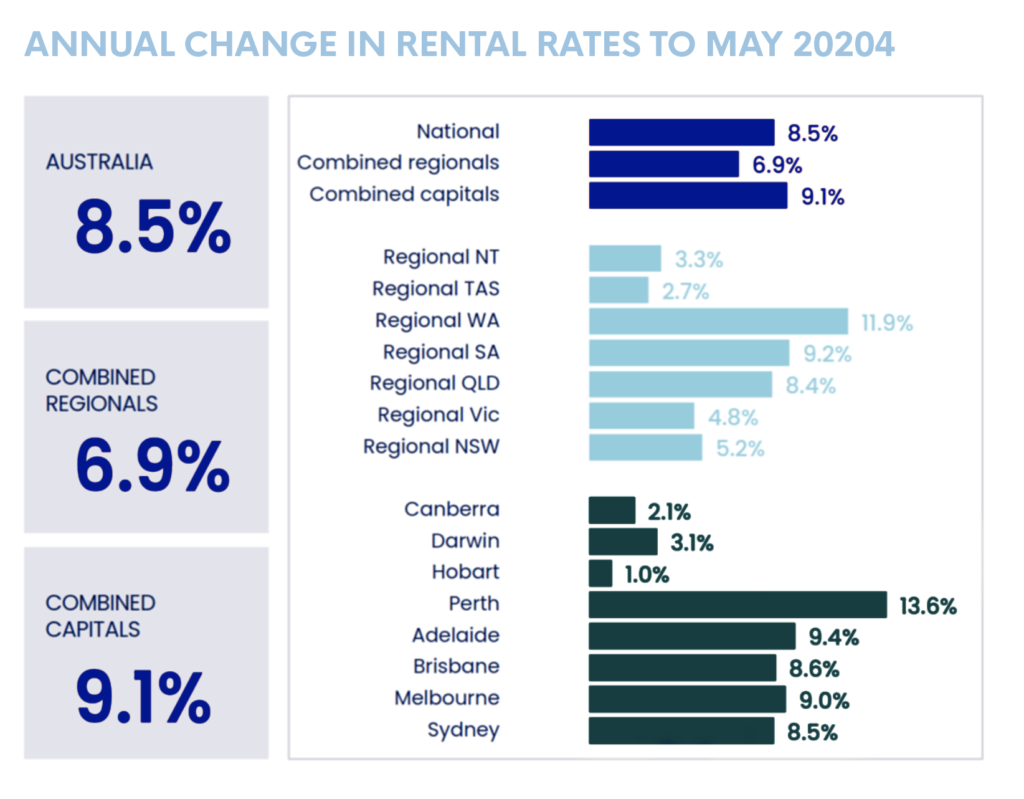

Reserve Bank of Australia (RBA) Governor Michelle Bullock has stated on several occasions that inflation, not interest rates, are at the heart of cost of living pressures. Interest rates are the RBA’s “blunt instrument” to bring inflation under control. With inflation easing more slowly than anticipated, the RBA is not ruling anything out because the path of interest rates is determined by the actions required to bring inflation to target.

Inflation has reduced from its peak of 7.8% in December 2022 to 3.6% in the March quarter, but increased again in May to 4% dampening expectations of an interest rate reprieve.

Business confidence

The latest NAB business survey is not happy reading with business confidence falling back into negative territory in May as conditions continued to gradually soften. Having experienced eight consecutive months of forward order declines, businesses are understandably circumspect over the outlook. GDP grew marginally in the March quarter and consumption per capita continued to decline.

However, labour market conditions are strong with unemployment at 4% for May.

Treasury forecasts that economic growth (GDP) will marginally improve to 2% in 2024-25. Not exciting but credible.

Migration & labour

Always a controversial topic. Post pandemic, Australia’s migration levels surged with the return of international students, working holiday makers, and an influx of temporary skilled labour to meet shortages.

In the year ending 30 June 2023, overseas migration contributed a net gain of 518,000 people to Australia’s population – the largest net overseas migration estimate since records began.

The 2024-25 Federal Budget estimates that net migration will fall to 260,000. While demand pressures from migration have been well publicised, particularly on housing, the positive impact was the impact on supply. Post COVID, Australia faced crippling labour shortages that impeded the return and growth of supply.

From 1 January 2025, student visa numbers will be capped, and according to the University of Melbourne Deputy Vice-Chancellor Professor Michael Wesley, student visa grants are already down 34% in March 2024 compared to the same time in 2023.

The Government’s focus is on skilled migration. Employer sponsored places will rise by 7,175, however skilled independent visas will reduce by 13,475.

The minimum salary requirement to sponsor an employee (Temporary Skilled Migration Income Threshold) will also increase to $73,150 on 1 July 2024.

What now?

Businesses fail (or fail to thrive) for a myriad of reasons, but the precursor is often a failure to understand what is occurring within the business and what to monitor. Strategically, managers need to be on top of their numbers to identify and manage problems before they get out of hand. If you do not know what the key drivers of your business are, then it’s time to find out (we can help you with that).

A lack of profit will erode your business, but not enough cash will kill it stone dead. Businesses often fail because they don’t manage their cash position. Plan, track, and measure your cashflow. This not only means closely monitoring your debtor collections and inventory but also running a rolling three month cashflow position. This should provide an early warning of any brewing problems.

Cash flows, operating budgets, cost control and debt management all need to be part of your business management. The more in control you are the lower your risk position.

Many small businesses also tend to absorb increasing costs. Putting up your prices during difficult times is not an act of social betrayal. If the cost of doing business has increased, you should flow these through unless you are comfortable making less for the same amount of effort, or you are in an industry that is so price sensitive you have no choice but to follow the lead of larger businesses.

$20k instant asset write-off passes Parliament

Legislation increasing the instant asset write-off threshold from $1,000 to $20,000 for the 2024 income year passed Parliament just 5 days prior to the end of the financial year.

Purchases of depreciable assets with a cost of less than $20,000 that a small business makes between 1 July 2023 and 30 June 2024 can potentially be written-off in the year of purchase. It’s a major cashflow advantage because the tax deduction can be taken in the year of purchase instead of over a number of years.

To be eligible, the asset must be first used, or installed ready for use, for a taxable purpose between 1 July 2023 and 30 June 2024. For example, you cannot simply have a receipt for an industrial fridge, it must have been delivered and installed to be able to claim the write-off in 2024.

The write-off threshold applies per asset, so a small business entity can potentially deduct the full cost of multiple assets across the 2024 year as long as the cost of each asset is less than $20,000. A Bill to extend the instant asset write-off threshold increase to 30 June 2025 is currently before Parliament.

The instant asset write-off

The instant asset write-off threshold increased from $1,000 to $20,000 for 2023-24. Here’s what it means:

The increase to the instant asset write-off threshold provides a major cashflow advantage by enabling small businesses to claim an immediate tax deduction for certain assets in the year of purchase, instead of spreading the deduction over a number of years.

Remember that the deduction is not a refund, it will only reduce the taxable income of the business entity, or in some cases, it will create or increase a tax loss that needs to be carried forward to future years. For example, if your business operates through a company structure, the economic benefit of the write-off is limited to the relevant company tax rate (25% for base rate entities, 30% for other companies). If your business is likely to make a tax loss for the year, then a larger deduction might not provide any short-term benefit.

Eligibility

Eligibility to access the instant asset write-off looks at both your business entity and the asset.

To utilise the instant asset write-off, your business entity must:

- Be carrying on a business under general principles in the 2024 income year;

- Have an aggregated annual turnover of less than $10m (the businesses annual turnover, plus the annual turnover of any connected business entities or affiliates) in the 2024 income year or 2023 income year;

- Choose to apply the simplified depreciation rules for the 2024 income year. If your business does not choose to apply the simplified depreciation rules for the 2024 income year, then it won’t have access to the instant asset write-off rules, regardless of whether the other basic conditions can be met.

And, for an asset to be eligible, it must:

- Fall within the scope of the depreciation provisions. There are some assets, like horticultural plants, capital works (building construction costs etc.), assets leased to another party on a depreciating asset lease, etc., that don’t qualify.

- Cost less than $20,000. If your business is registered for GST, the cost of the asset needs to be less than $20,000 after GST credits have been subtracted. If your business is not registered for GST, it is $20,000 including GST; and

- Be first used, or installed ready for use, for a taxable purpose between 1 July 2023 and 30 June 2024. This prevents business operators from stockpiling purchases and claiming tax deductions for goods they have no intention of using in the short- term. So, if your business purchased an asset on 20 May 2024, it had to be used or installed and ready to use by 30 June 2024 to qualify for the immediate deduction in 2023-24.

- Be for a business use. Ensure that there is a relationship between the asset purchased and how your business generates income. A business can’t, for example, claim deductions for multiple television sets if the sets have no relevance to the business.

The provisions that prevent small business entities from re-entering the simplified depreciation regime for five years if they opt-out will continue to be suspended until 30 June 2024 (the lock-out rules).

What happens when assets cost more than $20,000?

If your business is a small business entity and chooses to apply the simplified depreciation rules, then assets costing $20,000 or more (that cannot be immediately deducted) can continue to be placed into the small business general pool and depreciated at 15% in the first income year and 30% each income year thereafter.

The increased instant asset write-off threshold also means that a $20,000 threshold applies for the purpose of determining whether the full pool balance is written off in the 2024 income year. Just remember that when you are applying these rules, you don’t look at the closing pool balance, you are looking at what the pool balance would have been if you ignored the current year depreciation deductions for the pool for the 2024 year.

How many assets can be purchased?

The write-off threshold applies per asset, so a small business entity can potentially deduct the full cost of multiple assets. Assuming all the other conditions are met, an immediate deduction should be available for each individual item costing less than $20,000 – just be careful of cashflow.

What about second-hand goods?

The instant asset write-off does not distinguish between new or second-hand goods. For example, second hand machinery may qualify if it meets the other requirements.

Extension until 30 June 2025

In the 2024-25 Federal Budget, the Government announced an extension to the increased instant asset write-off threshold to 30 June 2025. A Bill is currently before Parliament to enact this change.

Is your family home really tax free?

The main residence exemption exempts your family home from capital gains tax (CGT) when you dispose of it. But, like all things involving tax, it’s never that simple.

As the character of Darryl Kerrigan in The Castle said, “it’s not a house. It’s a home,” and the Australian Taxation Office’s (ATO) interpretation of a main residence is not fundamentally different. A home is generally considered to be your main residence if:

- It’s where you and your family live

- Your personal belongings have been moved into the dwelling

- It is where your mail is delivered

- It’s your address on the electoral roll

- You have connected services such as telephone, gas and electricity (in your name); and

- It is your intention for the home to be your main residence.

The length of time you have lived in the home is important, but there are no hard and fast rules. Your intention takes precedence over time spent as every situation is different.

When does the main residence exemption apply?

In general, CGT applies to the sale of your home unless you have an exemption, partial exemption, or you can offset the tax against a capital loss.

If you are an Australian resident for tax purposes, you can access the full main residence exemption when you sell your home if:

- Your home was your main residence for the whole time you owned it (see Can the main residence apply if you move out?).; and

- You did not use your home to produce any income (see Partial exemption below), and

- The land your home is on is 2 hectares or less. If your home is on more than 2 hectares, for example on farmland, the exemption can apply to the home and up to 2 hectares of adjacent land.

Partial exemption

If you have used your home to produce income, you won’t normally be able to claim the full main residence exemption, but you might be able to claim a partial exemption.

Common scenarios impacting your main residence exemption include:

- Running a business from home (working from home is ok), and

- Renting the home or part of the home.

In these scenarios, from the time you started to use the home to generate income, that part of the home is likely to be subject to CGT. And, a word of caution here, as of 1 July 2023, platforms such as Airbnb must report all transactions to the ATO every 6 months. This data will be used to match against the income reported on income tax returns.

Foreign residents and changing residency

Foreign residents cannot access the main residence exemption even if they were a resident for part of the time they owned the property.

If you are a non-resident at the time you enter into the contract to sell the property, you are unlikely to be able to access the main residence exemption. Conversely, if you are a resident at the time of the sale, and you meet the other eligibility criteria, the rules should apply as normal even if you were a non-resident for some of the ownership period. For example, an expat who maintains their main residence in Australia could return to Australia, become a resident for tax purposes again, then sell the property and if eligible, access the main residence exemption.

It’s important to recognise that the residency test is your tax residency, not your visa status. Australia’s tax residency rules can be complex. If you are uncertain, please contact us and we will work through the rules with you.

Can the main residence apply if you move out?

You might have heard about the ‘absence rule’. This rule allows you to continue to treat your home as your main residence for tax purposes:

- For up to 6 years if the home is used to produce income, for example you rent it out while you are away; or

- Indefinitely if it is not used to produce income.

When you apply the absence rule to your home, this normally prevents you from applying the main residence exemption to any other property you own over the same period. Apart from limited exceptions, the other property is exposed to CGT.

Let’s say you moved overseas in 2020 and rented out your home while you were away. Then, you came back to Australia in 2023 and moved back into your house. Then in early 2024, you decided it is not your forever home and sold it. You elected to apply the absence rule to your home and didn’t treat any other property as your main residence during that same period. In this case, you should be able to access the full main residence exemption assuming you are a resident for tax purposes at the time of sale.

The 6 year period also resets if you re-establish the property as your main residence again, but later stop living there. So, if the time the home was income producing is limited to six years for each absence, it is likely the full main residence exemption will be available if the other eligibility criteria are met.

Timing

Your home normally qualifies as your main residence from the point you move in and start living there. However, if you move in as soon as practicable after the settlement date of the contract, that home is considered your main residence from the time you acquired it.

If you buy a new home but haven’t yet sold your old home, you can treat both properties as your main residence for up to six months without impacting your eligibility to the main residence exemption. This applies if the old home was your main residence for a continuous period of 3 months in the 12 months before you disposed of it and you did not use your old home to produce income in any part of that 12 months when it was not your main residence.

If the sale takes more than six months and if eligible, the main residence exemption could apply to both homes only for the last six months prior to selling the old home. For any period before this it might be possible to choose which home is treated as your main residence (the other becomes subject to CGT).

If your new home is being rented to someone else when you purchase it and you cannot move in, the home is not your main residence until you move in.

If you cannot move in for some unforeseen reason, for example you end up in hospital or are posted overseas for a few months for work, then you still might be able to access the main residence exemption from the time you acquired the home if you move in as soon as practicable once the issue has been resolved. Inconvenience is not a valid reason and you will need to ensure that you have documentation to support your position.

Can a couple have a main residence each?

Let’s say you and your spouse each own homes that you have separately established as your main residences.

The rules don’t allow you to claim the full CGT exemption on both homes. Instead, you can:

- Choose one of the dwellings as the main residence for both of you during the period; or

- Nominate different dwellings as your main residence for the period.

If you and your spouse nominate different dwellings, the exemption is split between you:

- If you own 50% or less of the residence chosen as your main residence, the dwelling is taken to be your main residence for that period and you will qualify for the main residence exemption for your ownership interest;

- If you own greater than 50% of the residence chosen as your main residence, the dwelling is taken to be your main residence for half of the period that you and your spouse had different homes.

The same rule applies to your spouse.

The rule applies to each home that the spouses own regardless of how the homes are held legally, i.e., sole ownership, tenants in common or joint tenants.

What happens in a divorce?

Assuming the home is transferred to one of the spouses (and not to or from a trust or company), both individuals used the home solely as their main residence over their ownership period, and the other eligibility conditions are met, then a full main residence exemption should be available when the property is eventually sold.

If the home qualified for the main residence exemption for only part of the ownership period for either individual, then a partial exemption might be available. That is, the spouse receiving the property may need to pay CGT on the gain on their share of the property received as part of the property settlement when they eventually sell the property.

The main residence exemption looks simple enough but it can become complex quickly. You will need more than a ‘vibe’ to work with the exemption. In the words of the character of Dennis Denuto in The Castle, “it’s the vibe of it. It’s the constitution. It’s Mabo. It’s justice. It’s law. It’s the vibe and ah, no that’s it. It’s the vibe. I rest my case.”

Earned an income from the sharing economy?

It’s essential that any income earned from sharing economy platforms such as Airbnb, Stayz, Uber, etc., is declared in your tax return.

Since 1 July 2023, the platforms delivering ride-sourcing, taxi travel, and short-term accommodation (under 90 days), have been required to report transactions made through their platform to the ATO under the sharing economy reporting regime. 2023-24 is the first year that the ATO will have the income tax returns of taxpayers to match to this data.

All other sharing economy platforms will be required to start reporting from 1 July 2024.

This reporting regime, combined with the ATO’s data matching programs, mean that if income is not declared, it’s likely you will receive a “please explain” request from the regulator.

FIND OUT MORE AT stanfordbrown.com.au